Starting a business without capital often feels impossible. Many assume you need investors, savings, or loans. But today, AI has changed the game. With AI tools, you can generate income fast, test business ideas, and fund your startup with minimal cost.

AI isn’t just for tech experts. Freelancers, creatives, and entrepreneurs are using AI to start businesses from scratch. By leveraging AI, you can make money while developing the foundation for a scalable business.

This guide will show you:

- How to quickly earn your first income with AI side hustles.

- Medium-term strategies to grow revenue and diversify income.

- Customer-funded models, pre-sales, and subscriptions.

- Grants, competitions, and crowdfunding options for non-equity funding.

- A detailed 30-day action plan to turn ideas into capital.

By the end, you will understand exactly how to make money to start your business, even if you have no money, little experience, or limited resources.

Why AI Side Hustles Are the Fastest Way to Fund Your Business

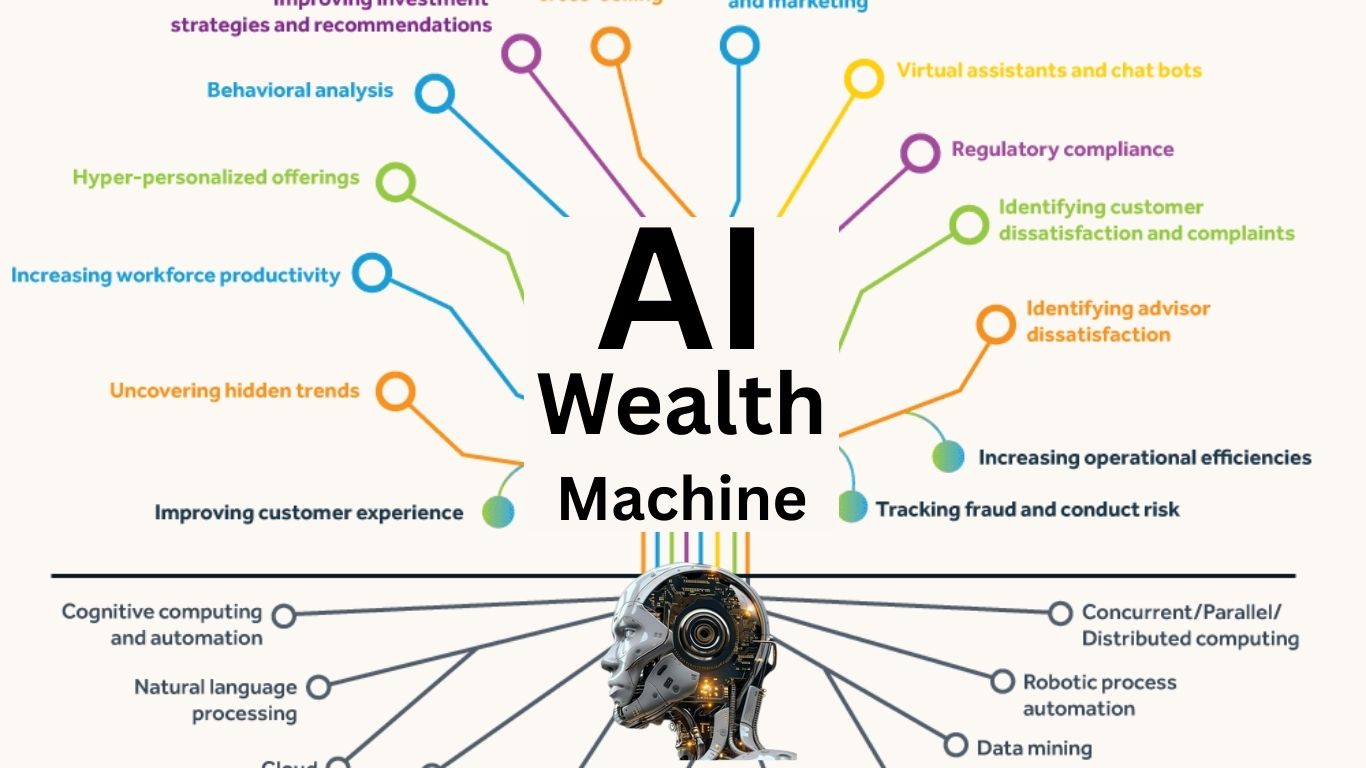

AI allows entrepreneurs to generate money quickly because it reduces the time, cost, and skill required for many tasks. You can provide services or products powered by AI that previously required a team or significant investment.

Low Barrier to Entry

AI tools are often free or low-cost. Platforms like ChatGPT, Jasper, DALL·E, MidJourney, Canva AI, and Zapier allow almost anyone to produce professional-quality content, designs, or automation systems. You don’t need to hire staff or buy expensive software.

This accessibility makes AI side hustles ideal for low cost businesses to start, enabling you to quickly test ideas and generate revenue.

Fast Income Generation

AI drastically reduces the time required for business tasks. Writing a blog post, designing graphics, or creating a social media campaign can now take minutes instead of hours. This efficiency allows you to serve multiple clients or customers, accelerating income generation.

Validate Your Business Idea

Starting with AI services or products lets you validate demand before investing heavily. By offering AI-powered solutions, you can gauge customer interest, receive feedback, and iterate on your business model without risking capital.

Quick AI-Based Income Ideas

These strategies are designed to help you earn $300–$1,500 quickly. They rely on factual, widely available AI tools and proven business methods.

AI Content Writing Services

Use AI tools to produce written content for clients. You can create blog posts, email newsletters, product descriptions, or social media content.

To start:

- Identify a niche where content demand is high. Popular options include tech, finance, lifestyle, and e-commerce.

- Use ChatGPT or Jasper to draft content efficiently.

- Edit and optimize content for clarity, SEO, and client requirements.

- Charge per article or package. New freelancers typically earn $50–$100 per post.

Freelance platforms like Fiverr, Upwork, or even local business outreach can help you secure your first clients.

AI Graphic Design

AI tools allow you to create professional graphics for businesses or individuals without prior design experience. MidJourney, DALL·E, and Canva AI can generate banners, social media visuals, and marketing materials.

The process:

- Gather the client’s design brief and preferences.

- Generate multiple options using AI tools.

- Refine and deliver the final images.

Clients typically pay $50–$200 for a complete package, depending on complexity.

AI Prompt Packs and Templates

AI prompts can be packaged and sold as digital products. For example, you can create prompts for writing marketing copy, social media captions, or e-commerce listings.

Steps:

- Research and create high-performing prompts.

- Organize them into a themed pack.

- Sell them via platforms like Gumroad, Koji, or your own website.

Pricing varies, but typical packs sell for $10–$50.

Micro-Consulting and AI Audits

Offer consultations where you analyze a client’s business processes using AI tools and provide actionable recommendations.

Implementation:

- Audit processes using AI-powered insights.

- Suggest automation, content strategies, or workflow improvements.

- Charge $50–$200 for 30–60 minute sessions.

AI Chatbots and Automation Services

Set up AI-powered chatbots or automation workflows for small businesses.

Steps:

- Identify repetitive tasks or customer engagement needs.

- Use tools like ManyChat or Zapier to build automation.

- Deliver setup and training to the client.

- Charge $100–$300 per project.

Medium-Term AI and Hybrid Hustles (Weeks 2–6)

After earning initial income, you can expand into medium-term strategies that combine AI with other services or products.

Digital Product Creation

AI can help you create scalable digital products such as e-books, mini-courses, templates, or spreadsheets.

Steps:

- Identify a niche problem to solve.

- Use AI to generate content, graphics, and layouts.

- Package the product for sale on Amazon Kindle, Gumroad, or your website.

- Price according to depth and demand ($9–$49 for small digital products).

This strategy allows for revenue without additional client work, turning one-time effort into recurring sales.

Hybrid Freelance + AI Workflow

Combine freelance services with AI to serve more clients efficiently.

For example:

- Offer social media management services.

- Use AI to generate posts, captions, and scheduling.

- Focus your time on strategy, client communication, and final edits.

This model lets freelancers increase earnings without increasing hours worked.

Membership or Micro-Subscription Services

Recurring income stabilizes cash flow. Examples include:

- Weekly AI prompt packs for marketing or design.

- AI-generated content packs for small businesses.

- Monthly templates or automation scripts.

Start small, reinvest profits to grow subscribers, and scale gradually.

Licensing AI Templates or Systems

If you develop AI templates, workflows, or micro SaaS solutions, license them to other businesses.

- AI chatbots, automation scripts, and content systems are all licensable.

- Revenue can be one-time or subscription-based.

Pre-Selling and Customer-Funded Models

Pre-selling is an effective way to start a business with no upfront investment by securing customers before creating the full product.

How Pre-Selling Works

- Create a mockup or prototype using AI tools.

- Build a landing page using platforms like Carrd, Wix, or Leadpages.

- Offer early-bird pricing to attract first buyers.

- Deliver a minimum viable product (MVP) using AI tools.

Example: Pre-selling 50 AI-generated logo packs at $29 each could raise $1,450 before production.

Marketing Pre-Sales

Promote your pre-sale via social media, email campaigns, and online communities. Use AI to automate emails, write compelling copy, and create visuals. Highlight limited availability to create urgency.

Combining Pre-Sales with AI Services

Use pre-sale income to fund additional AI side hustles. Reinvest profits to develop digital products, memberships, or licensed templates, creating a cycle of self-funding growth.

Grants, Competitions, and Non-Equity Funding

External funding can accelerate your growth without giving away equity.

Government Grants

Look for small business grants or innovation funds. Examples include:

- Small Business Innovation Research (SBIR) programs.

- Local technology or entrepreneurship grants.

NGO and Private Funding

Some NGOs or private organizations provide grants for entrepreneurs, women, or minority founders. Focus on clear problem statements, social impact, and AI-based solutions.

Competitions and Incubators

AI-focused competitions and incubators offer cash prizes, mentorship, and sometimes workspace. Examples: Y Combinator, Techstars, and local startup competitions.

Crowdfunding Platforms

Kickstarter, Indiegogo, and GoFundMe allow pre-selling products to fund production. Use AI-generated mockups and automated marketing for stronger campaigns.

Avoiding Costly Mistakes

Starting a business without proper planning can be risky. Avoid:

- Predatory loans with high interest rates.

- Giving away too much equity before validating your idea.

- Overestimating potential revenue.

- Skipping market validation or testing.

- Overcomplicating your business model instead of starting simple.

Scaling and Reinvesting Earnings

After initial success:

- Allocate 50–70% of profits to marketing, upgrading AI tools, and outsourcing repetitive tasks.

- Hire freelancers for editing, customer support, or content optimization.

- Track metrics such as monthly recurring revenue, client acquisition cost, and retention.

- Consider microloans, crowdfunding, or venture capital only after consistent revenue.

Advanced AI Income Ideas

- AI voiceovers using ElevenLabs for podcasts, audiobooks, or marketing content.

- AI video creation using RunwayML or Pictory for social media clips or explainers.

- AI coding and automation using GitHub Copilot to develop small SaaS products or scripts.

- Emerging tools like ChatGPT plugins, AI CRMs, and automated reporting systems.

Case studies demonstrate that freelancers and small businesses can generate $300–$2,000/month using these AI-powered models.

FAQ

Yes, AI services like writing, design, and automation allow income generation without upfront investment.

$300–$1,500 is achievable depending on effort and demand.

Content creation, social media management, e-commerce, marketing automation, and prompt engineering are high-demand areas.

Use AI-generated mockups, prototypes, and clear communication. Offer early-bird pricing and limited slots.

Yes, when used properly. Always review outputs for quality and relevance.

Final Thoughts

Starting a business doesn’t require large capital. With AI-powered side hustles, pre-sale strategies, grants, and low-cost business models, you can generate startup funds quickly.

Follow the 30-day action plan, validate your ideas, and reinvest earnings. By leveraging AI effectively, you’ll understand how to make money to start your business, build a foundation for growth, and scale sustainably.

Start today. Pick one AI side hustle, create your first product or service, and begin funding your business immediately.